Good question. Nobody wants to spend money buying gold, only to find the price of gold falls the day after.

That said, buying gold is a lot less scary than buying stocks. Even if you buy gold at the wrong time, and prices start falling, gold prices generally fall slowly. By contrast, stock prices can fall very quickly, and dramatically.

Is this true? Sure it is. Take a look at this chart of gold prices over the last 5 years. Chart courtesy of Kitco.com

As you can see, for most of the time the price goes up and down, with a general upward trend. But when the price does go down, it generally loses only a few percentage points in value before moving up again.

This last 5 years isn’t exceptional. Charts for other years over the last decade look similar.

The point is, gold values don’t crash in the same way that stock prices can.

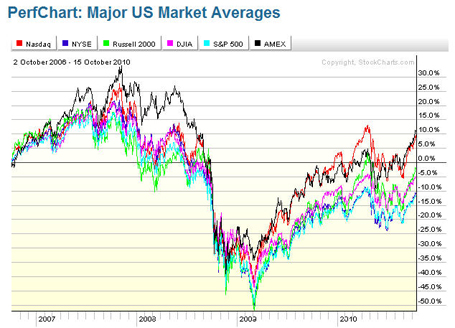

Now take a look at stock price movements over a similar time frame. Chart courtesy of StockCharts.com.

Yes, we had an exceptionally tough time in 2008, but this chart does serve to illustrate how stock prices can change very dramatically. If you buy a stock this morning, it can lose significant value by the end of the day, either because of that single company’s performance, or because of a general shift in the market as a whole.

But with gold, the changes take place more slowly, and less dramatically.

So if you do buy gold, and the price starts falling, you have a couple of choices, and some time in which to make up your mind.

First, you can decide to sell, without losing too much. Although you need to factor in the costs associated with selling.

Second, if you are confident that gold prices will continue to rise, ride out the fall in price and wait for things to improve.

Given the current movement of gold in a steady upward direction, the second option is probably your best.